Sealing the deal

Just like the caulking and sealing products it creates, Colorado-based Sashco thrives on being durable and resilient.

Early on in its nearly-90-year history, the family-based company weathered through a change that would have caused many companies to crumble—the unexpected death of its founder Donald J. Burch in a plane crash in 1954. He left behind his pregnant wife Alice, a 4-year-old son and a thriving business that was operating seven warehouses across the U.S. and a second manufacturing facility in Seattle.

Meet Sashco

Founded: 1936, as the Colorado Steel Sash Company (hence “Sashco,” as it’s known today).

What they do:

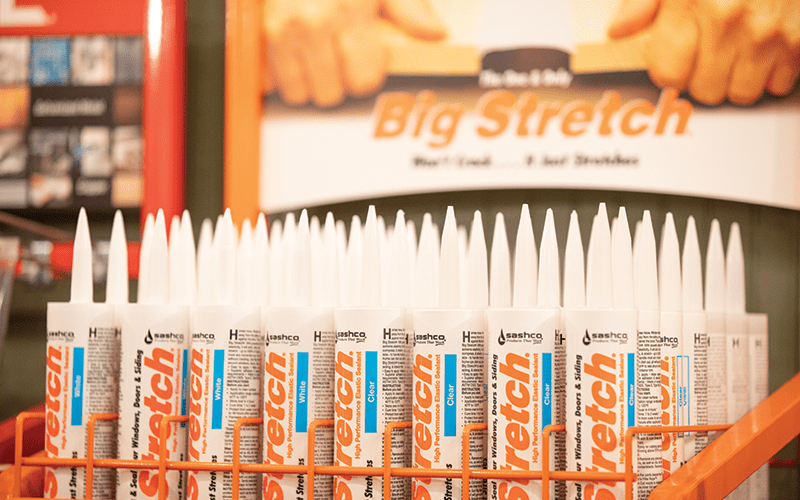

Headquartered in Thornton, Colo., just outside of Denver, Sashco makes caulking, sealant and wood staining products. Their products are used for the construction and remodeling of conventional homes, as well as log homes, and their primary client base includes retailers such as lumberyards, hardware stores and paint stores.

A family business:

Nearly 90 years after Les Burch’s father, Donald, founded Sashco, the company remains in the Burch family. Now with Les at the helm, his sons Nick and Jeff also help lead the company. Having both sons work for Sashco was never a set plan, but if they did, Les wanted them to work at different companies first to build confidence and gain experience marketing their skills. Both Nick and Jeff did this and ultimately decided to return to work in the family business.

How they made their mark:

In addition to being a multi-decade, family-run business, Sashco has made its mark by having a product line designed for the maintenance and protection of traditionally built homes as well as log homes. Additionally, Sashco’s website fosters an online community where both “DIYers” (do-it-yourself) and professionals can share their tips and experiences

For a decade after Donald’s death, innovation at Sashco stopped—but then, in 1964, Alice stepped in and took over management of the company, hoping to preserve it for her children. It was a move that some may have thought unusual for a woman in the 1960s. But Alice didn’t care. “She wouldn’t let that get in her way, even if it was,” said Donald and Alice’s son, Les Burch, who is now president of Sashco. “But what ended up happening is that she came in not really understanding the business very well, so she relied on her suppliers and vendors to teach her. She was a great learner and she had a knack for inquiry. With almost anybody she met, she would know more about them than you could believe in about a 10-minute conversation.”

“She was very open to advice and all that information, but it was still a difficult time period because our formulas had deteriorated and our financial status was not what the books said. She found out she had all kinds of old inventory that was carried on the books as viable, and it wasn’t. It was waste material, so it took a difficult 10 years to turn the company around.”

Taking on the unknown with BOK Financial at their side

But Alice succeeded against these odds, and in 1972, Les joined the family business as a graduate chemical engineer. He soon became president when Alice retired. Today, Sashco has carried on to the next generation with Les’s own sons—Nick, who serves as director of finance, and Jeff, a strategic selling manager.

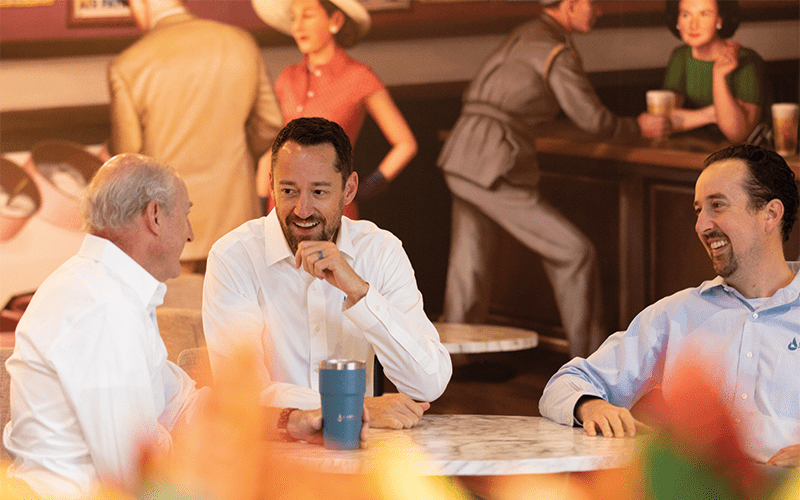

Like their forbearers, Les, Nick and Jeff also have navigated Sashco through change with the help of quality information and advice. In fact, BOK Financial Relationship Manager Sean Kelly’s skill providing this help beyond dollars and cents is one of the things they say they appreciate about him and BOK Financial most.

"BOK Financial didn’t just look at the numbers. They looked at the whole reason why the numbers were the numbers.”

Nick Burch, Director of finance for Sashco

“I think what Sean brings to the table is this ability to take a broad view of the dynamics and be able to talk about it,” Les said. “He understands what we’re trying to accomplish.” BOK Financial’s help when Sashco wanted to build a new headquarters building really stands out, Nick recalled. “We were doing cash flow analysis and there were, as my brother Jeff likes to say, ‘Ten big unknowns that could have derailed the project at any time.’”

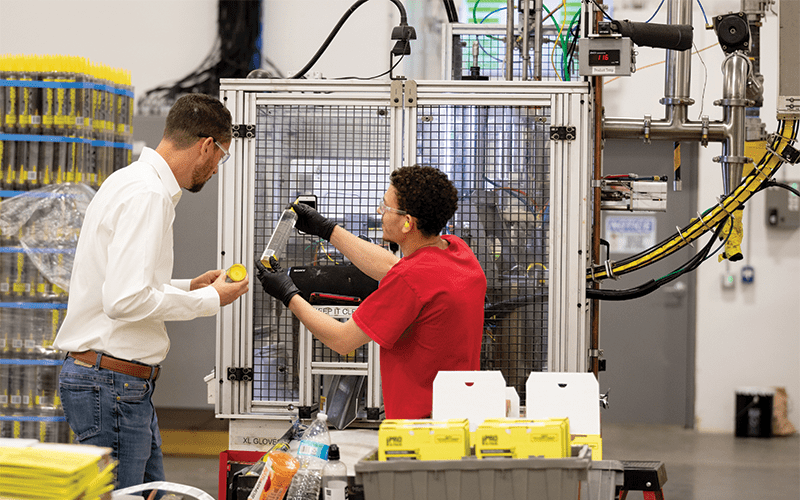

Sashco asked BOK Financial to increase their line of credit from $5 million to $7.5 million and, as they were going through that process, inflation hit, compressing Sashco’s margins. But Kelly wasn’t deterred.

“BOK Financial didn’t just look at the numbers. They looked at the whole reason why the numbers were the numbers,” Nick explained. “Having access to that additional line of credit was a big deal because we were dealing with millions of dollars that could come due at any point, and we didn’t know when exactly those bills would come."

“We had to be flexible with the fact that the project plan was going to need to adjust, especially as it was all happening during supply chain delays and labor shortages,” he continued. “There were a lot of twists and turns in the project which required solid collaboration.”

Because Sashco is a specialized manufacturer, another challenge arose because there were elements of the building that are traditionally difficult for banks to finance, Kelly noted.

“But Sashco’s strength provided them with a lot of options. They had run their business well and were financially responsible.”

"They wanted us engaged in the process, so knowing upfront that it was going to be a journey that we would go on together set the tone.”

Sean Kelly, BOK Financial relationship manager

An ally for today and tomorrow

The relationship between BOK Financial and Sashco has grown and developed over the years, as has the relationship between Kelly and the Burch family. Originally, Sashco only used the financial services company for deposits. Since then, BOK Financial has not only provided Sashco with financing for the building but also for specialized equipment. Along the way, as interest rates rose, BOK Financial was able to help Sashco lock in rates.

It’s a connection that both parties value for today and what’s to come. “We feel good about the integrity of BOK Financial,” Les said.

And the feeling is mutual. In Kelly’s words, “This is a type of relationship that we strive to have with all our clients: to get to know your bank on a multifaceted level, and treat us as a partner, not a vendor.”

3 ways to ensure financial options— even in times of uncertainty

Sashco’s strength as a company enabled it to have multiple financial options despite pressure from rising inflation.

Here’s what you need to have—and articulate to your banker—to ensure you have options on the table, even in the face of economic uncertainty, according to Kelly:

- Have a strong leadership team: In Sashco’s case, the Burch family has been leading the company for multiple generations.

- Know your company’s past performance: You should also be able to explain the reasons behind that performance and share any nuances with your banker.

- Have an eye on the future: In addition to having a good grasp on your company’s past performance, you should also be able to articulate the opportunities and risks that may lie ahead for your business, how you plan to mitigate those risks, and any key performance indicators that you’re currently monitoring.

More success stories

-

A partnership built to last

Discover how a revolving line of credit supported MTech for 20+ years of transforming Colorado’s cityscape.

-

Continuing its mission

A line of credit helped the nonprofit arc Thrift Store expand while continuing to enhance the lives of people with disabilities.

-

Enter sandman

Asset-based lending provided working capital to help this young company sustainably scale up.