Environmental, Social, and Governance

Although we began in 1910 as a local source of capital for the energy industry, we’ve grown to become one of the strongest, most vibrant financial institutions in the country, fueling economic growth and security across the American Midwest and Southwest serving a diverse spectrum of industries, institutions and individuals across the country. But even as we grow, the deep ties to the communities we serve drives our support of initiatives related to community advancement, equal opportunity, diversity and inclusion to levels well beyond the typical corporate commitments to education and job training in both size and scope.

Additionally, our majority shareholder and chair of the board, George Kaiser, initiates and funds major programs directed toward these purposes, further amplifying our corporate commitment. Mr. Kaiser created the George Kaiser Family Foundation whose mission is to create an environment where every family, no matter their background, has an opportunity to succeed. As a signatory of the Giving Pledge, he has committed to giving the majority of his wealth—well exceeding the net income and value of the company—to philanthropic or charitable causes.

As a company that makes capital available to energy producers—including oil and gas companies—we are committed to our response to climate change. However, we recognize that renewable resources will be unable to provide 100% of the world’s net energy needs for decades. Constraining the supply of hydrocarbons artificially merely raises the price of those fuels, disproportionately impacting those who can least afford higher costs—resulting in “E” at the expense of “S.”

We emphasize our ESG goals with our employees and encourage them to engage in driving initiatives supporting the spectrum—environmental, social and governance. Their passion for making our communities better places to live and work propels us ever forward.

This ESG review reflects not only the results of the company but also the work and commitment of our team members from across the company. Composed of company leaders, our ESG working group led the creation of this report which was also reviewed and approved by the Audit Committee of the Board of Directors.

“Our success is predicated on the success of our clients and is driven by that of our employees; in short, our company does well when our clients and our communities are doing well.”

Stacy Kymes

President & CEO

About us

BOK Financial is a top U.S.-based financial services company, offering sophisticated wealth, commercial, and consumer products and services. Still, we do business one client at a time, focused on delivering thoughtful expertise and tailored advice, because we know that when our clients succeed, we succeed.

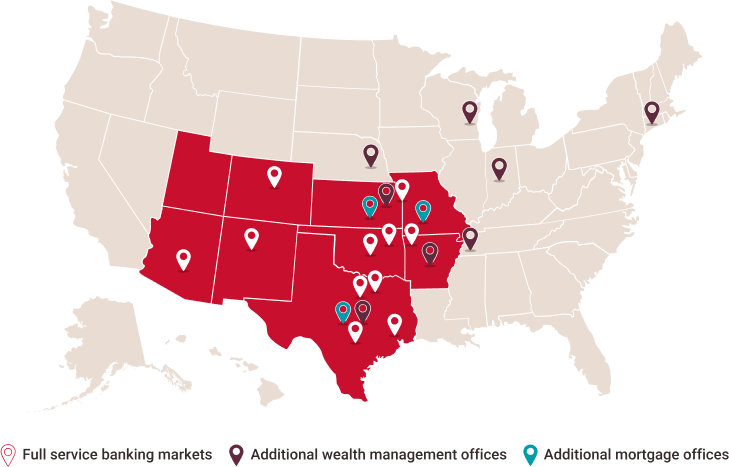

Headquartered in Tulsa, we serve the complete financial needs of families, international corporations and everything in between. We serve clients across the country from our operations focused in Oklahoma, Texas, Arizona, Arkansas, Colorado, Kansas, Missouri and New Mexico. Our services include commercial and consumer banking; brokerage and trading; investment, trust and insurance services; mortgage origination and servicing; and an electronic funds transfer network.

Strategic priorities

- Accelerate top-line growth

- Manage risk

- Win as a talent magnet

- Advance technology

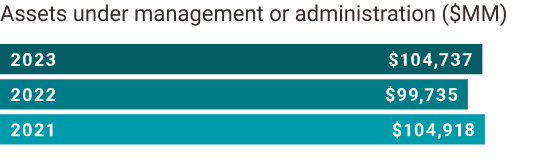

$531MM

Net income in 2023

$520 million net income in 2022

$618 million net income in 2021

4,966

Full-time employees in 2023

4,791 full-time employees in 2022

4,711 full-time employees in 2021

Average Loans ($MM)

Average Deposits ($MM)

Reference

BOK Financial Corporation is a regional financial services company headquartered in Tulsa, Oklahoma. The company’s stock is publicly traded on NASDAQ under the Global Select market listings (BOKF). BOK Financial Corporation’s holdings include BOKF, NA; BOK Financial Securities, Inc.; and BOK Financial Private Wealth, Inc. BOKF, NA operates TransFund and Cavanal Hill Investment Management. BOKF, NA operates banking divisions across eight states as: Bank of Albuquerque; Bank of Oklahoma; Bank of Texas and BOK Financial (in Arizona, Arkansas, Colorado, Kansas and Missouri); as well as having limited purpose offices in Nebraska, Wisconsin, Connecticut and Tennessee. Through its subsidiaries, BOK Financial Corporation provides commercial and consumer banking, brokerage trading, investment, trust and insurance services, mortgage origination and servicing, and an electronic funds transfer network. BOK Financial® is a registered trademark of BOKF, NA. For more information, visit bokf.com.

This review contains forward-looking statements that are based on management’s beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “outlook,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports.

BOK Financial Environmental, Social and Governance Review

In this document, BOK Financial provides disclosure of environmental, social, and governance topics and metrics that have been determined to be relevant to our company. The document was informed by the Sustainability Accounting Standards Board (SASB) standards for the Financials – Commercial Banks industry; direct reference was made to SASB standards to assist in the identification of information used for rating purposes throughout this report. This document covers the twelve months ended December 31, 2023, unless otherwise noted.