A partnership built to last

Only a few years ago, the space west of Coors Field, home of baseball’s Colorado Rockies, was just another unremarkable parking lot in downtown Denver. Today, it’s been transformed into McGregor Square, a vibrant mixed use development encompassing a new hotel, condos, office space, bars and restaurants, and a massive outdoor entertainment plaza. The complex is also another feather in the cap for MTech Mechanical, a Westminster, Colorado based mechanical design-build-maintain contractor. And it serves as one of many shining examples of how MTech’s work has transformed Colorado’s urban and suburban landscape over the past two decades.

Meet MTech Mechanical

Founded: 2002

What they do:

Based in Westminster, CO., MTech Mechanical is one of the state’s premier mechanical contractors, providing design-build services including engineering, construction, systems installation and maintenance. The company has led or served as a subcontractor on a wide variety of commercial and industrial projects throughout Colorado, with over 525 employees, and additional offices in Eagle, Loveland and Colorado Springs.

How they made their mark:

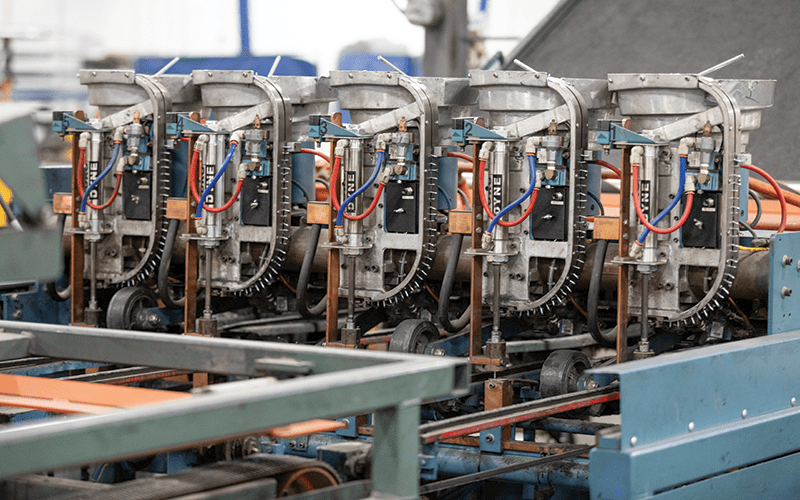

MTech has built a long and impressive track record of diverse construction projects: hospitals, office buildings, manufacturing facilities, data centers, multi-family residences, museums and much more. Known for its breadth of services, unwavering professionalism and high-quality workmanship, MTech has received numerous awards of excellence from national trade associations. Internally, the company takes pride in its people-first culture and was even named one of Colorado’s Top Workplaces by the Denver Post.

What sets them apart:

“A lot of contractors market themselves as ‘design-build,’ but we can really back it up,” said Shawn Kennedy, MTech’s chief financial officer. “We have a team of in house engineers, which allows us to drive the project and meet the needs of our client and their budget. We also self-perform plumbing, pipefitting, sheet metal pre-fabrication and installations, and offer service HVAC and plumbing. Those capabilities allow us to participate on many notable projects throughout our local communities."

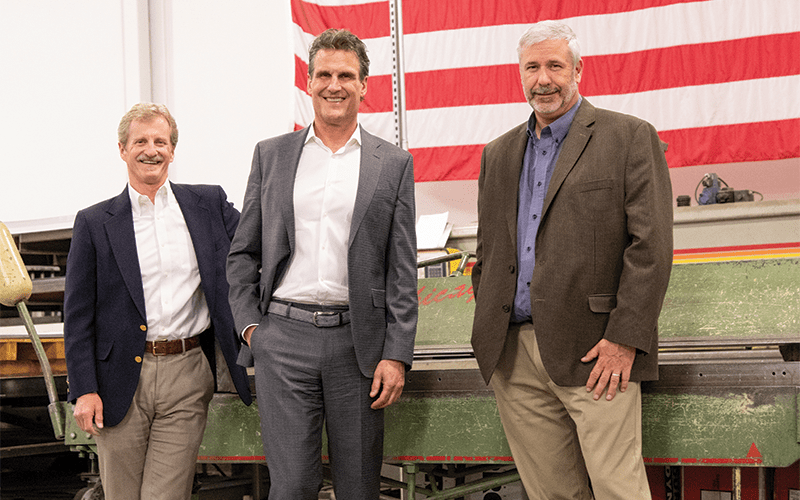

MTech was launched in 2002 by four founders who were coworkers at a prior firm. “We all had about 20 years of experience in the industry at that point, so we had a very clear vision of what we wanted to do,” said Marco Capitelli, a co-founder who serves as MTech’s president. “We knew if we could bring together great people and focus on building a great culture, we could create something very special.” Through the years, their shared vision has been repeatedly manifested in physical form. From research labs at world-class universities, to luxury apartment buildings, to an airport in the mountains, MTech has played a key role in designing, building and renovating many of Colorado’s most recognizable spaces, not to mention mission-critical facilities that most people never know exist.

With a comprehensive range of services and a deep bench of in-house expertise, MTech enjoys an excellent reputation for its technical capabilities. But Capitelli also knows the firm’s success hasn’t happened in a vacuum.

Standing the test of time

Early on, MTech found a banker they could trust and stuck with him. Bob Gaddis, now a market manager at BOK Financial, has worked with MTech

throughout its entire 21-year existence. “Bob has been there for us since the beginning,” said Capitelli, “and BOK Financial has become one of our most valued partners.” The banking relationship began in 2001, when Capitelli and his co-founders were just getting MTech off the ground. Based on a referral from a mutual contact, they called Gaddis, who issued MTech a revolving line of credit to help them fund their early growth. With that, a long-term partnership was born.

"Most companies don’t grow all on their own. They have a support system, a network of trusted partners they can rely on.”

Marco Capitelli, co-founder MTech

As MTech’s success fueled steady expansion through the years, their banking needs evolved as well. From business loans and treasury services to payroll and cash management, Gaddis has always been MTech’s first and only call.

“Bob knows our business and our client base, and he understands our style,” said Capitelli. “We trust that he has our back.” The admiration runs both ways. “I hold the MTech team in very high regard,” said Gaddis. “They’re incredibly astute and prepared, and always abreast of best practices in the industry, which is why they’ve been so successful.”

What started as strictly a business relationship has matured into something more. Gaddis said he and Capitelli enjoy the occasional meal together, mixing shop talk with stories of family and future aspirations. “There’s an exchange of information and ideas that benefits us both, personally and professionally,” said Gaddis. It’s that level of mutual respect that allows Gaddis to be more than a typical banker for MTech; he serves as an important extension of their team. For example, as part of the company’s future leadership training program, Gaddis has shared his insights with up-and-coming MTech managers on the fundamentals of business banking and the intricacies and risks of the bank-contractor relationship. He has also worked with MTech to deliver several tailor-made financial solutions, such as facilitating a letter of credit to secure MTech’s captive insurance needs.

"In today’s business world, the rules are always changing. You have to be nimble and forward-thinking as an organization. Bob is always proactive in helping us understand new regulations or financial trends, and how they might apply to us.”

Shawn Kennedy, MTech's chief financial officer

Most notably, and as a testament to MTech’s solid and consistent operating history, several years ago the company’s large working capital line of credit was granted with no personal liability to its principal owners.

More than anything, Capitelli and Kennedy appreciate knowing they can call on Gaddis any time, for any reason. Gaddis was there to help MTech navigate the financial implications of the COVID-19 pandemic and vet government assistance programs. More recently, he was there to reassure the team when upheaval in the banking industry sent tremors of concern through American businesses. And he’ll be there for whatever issue arises next.

“Looking to the future, one of our biggest opportunities is adjusting to the shift toward sustainable construction, focusing on energy retrofits to create more efficient buildings. We have just launched a new Energy group to further diversify our services,” said Capitelli. “Just knowing that we have Bob and the stability of BOK Financial behind us to support our growth is very important.”

As MTech innovates to meet the evolving construction needs of tomorrow, BOK Financial will help them continue to build on a strong financial foundation.

“I’m just honored to have played some role in MTech’s success over the past 21 years,” said Gaddis. “And I’m excited to help with whatever the next chapter may hold.”

Letters of credit - what they mean for contractors

When a developer, landowner or general contractor hires a contractor for a major construction project, there’s a lot of risk involved. If the contractor fails to complete the job or do it correctly, it could lead to costly rework, penalties for missed deadlines, reputational damage and even safety hazards. Thus, the hiring company needs to have some guarantee that the contractor will be able to complete the project at an agreed-upon level of quality. One way the developer can protect itself is by requiring the contractor to provide a letter of credit before work can begin.

A letter of credit (LOC) is a financial agreement issued by a bank that guarantees payment of a specified dollar amount if certain conditions are not met. In this case, the contractor would apply for an LOC from their bank and (assuming the bank determines the contractor is financially sound or creditworthy) provide it to the developer. Then, if the contractor is unable to meet the requirements of the job, the developer (the “beneficiary” of the LOC) can request monetary compensation from the bank. LOCs are often used in place of surety bonds, which tend to be more complex and more difficult to enforce.

Five questions to ask your banker now

In today’s economic environment, it seems “ongoing uncertainty” is one of the few things business owners can count on. After COVID and the Great Resignation, inflation and rising interest rates, a banking industry shakeup and a still-looming recession, executives are justified in their apprehension.

While navigating through constant change is never easy, it helps to have a trusted team of advisors, one of whom should be an experienced commercial banker. More than serving as a source of capital, a capable banker can help companies understand the financial implications of big-picture issues and make informed strategic decisions. With some of today’s most common challenges in mind, here are five questions business owners may want to ask their banker

- How can we best use our resources to acquire and retain top talent?

- What’s the best way to manage lingering supply chain delays?

- How can we be prepared for a potential merger or acquisition?

- What can we do to make our business more resilient in a tough economy?

- How might the unsettled nature of the banking industry affect your bank, and (consequently) our business?

More success stories

-

Sealing the deal

See how an extended line of credit helped this multi-generational business grow and expand.

-

Continuing its mission

A line of credit helped the nonprofit arc Thrift Store expand while continuing to enhance the lives of people with disabilities.

-

Enter sandman

Asset-based lending provided working capital to help this young company sustainably scale up.