Business owners looking to ‘catch up’ on retirement savings

Four in 10 small business owners don’t think they’ll be able to retire by 65

If, for much of your business’s tenure, the profits have returned to the business, leaving little room for your retirement savings, you’re not alone.

More than one-third of small business owners have no retirement savings plan for themselves, according to data from SCORE, a nonprofit mentoring organization for small businesses.

It’s a phenomenon that Raymond Aguilera, partner with October Three Consulting, has heard time and time again, particularly in professional services partnerships like law firms.

“If I’m a business owner, the chances are I’m putting all my effort, all my time and all my extra capital into growing the business. I’m keeping my head down, hiring more employees and trying to make the business successful,” he said.

“Then, one day, I lift my head, and I’m 10 years away from retirement, and maybe I’ve contributed to my 401(k), and maybe I have a profit-sharing plan—but the truth is I haven’t contributed enough.”

What to do if you’re behind

Business partners or owners who are in this position of needing to catch up on retirement savings have several options, Aguilera said.

First, maximize your 401(k) contributions. However, the Internal Revenue Service limits the amount of annual contributions that individuals can make to tax-advantaged employer savings plans to $22,500, as of 2023. But, those aged 50 and older can make catch-up contributions of $7,500 beginning the calendar year they turn 50.

DB versus DC plans

Defined benefit (DB): With these plans, an employer agrees to provide contractually set, fixed payments to participants after they retire. Pensions are a type of DB plan.

Defined contribution (DC): With these plans, the amount participants receive after they retire depends on the contributions made into the plan. An employer may agree to match employees’ contributions by a certain amount, but that is not always the case. 401(k)s are a type of DC plan.

If you’re already at the limit of 401(k) contributions, business owners or partners then might want to look at maximizing profit-sharing plans as a way to help yourself and your employees save for retirement.

Then, if you still have money, you may want to look into a cash balance plan, Aguilera suggested. Cash balance plans are defined benefit (DB) plan in the sense that the lump sum payments a participant receives after retirement is decided in advance and written in the plan’s documentation.

By contrast, 401(k) plans are defined contribution (DC) plans, which means that the amount a participant receives after retirement depends on how much they contribute to the plan along the way.

Traditional pensions are also DB plans, but cash balance plans look and feel more like a 401(k) to participants and are sometimes called a hybrid of the two models. For instance, with a cash balance plan, each participant has an “account” that they can sign onto and watch grow, just as they would be able to check on a 401(k) balance.

Is a cash balance plan right for your business?

Nearly three-quarters of all cash benefit plan sponsors are small businesses, according to figures from October Three Consulting. Experts attribute the popularity among this group to the retirement catch-up ability that the plans provide.

Three questions to consider

Business owners deciding whether to offer a cash balance plan should ask themselves the following:

- Have I maxed out 401(k) contributions and profit sharing?

- Do I have an appetite and ability to put money in a cash balance plan for the next three years?

- Am I also willing and able to contribute 6% of employees’ pay to their retirement savings (6% total, taking into account all employer-offered retirement plans)?

“It’s a vehicle that really allows people to sock away a lot of money, especially in the last five to 10 years before retirement, and make up a lot of ground,” said Anthony Phillips, national sales director of retirement plans and asset services for BOK Financial.

Typically, owners, principals, high earners and those close to retirement get the most value from a cash balance plan. In addition to enabling participants to save larger sums for retirement more quickly than by just participating in a 401(k) and profit sharing, contributing to a cash balance plan also may enable high earners to reduce their modified adjusted gross income below $200,000 so they don’t have to pay a net investment tax on unearned income.

Meanwhile, for employers, another factor to consider is that offering a cash balance plan may help attract and retain top talent, which has been particularly important during the persistently tight labor market, Phillips added.

Reducing the impact of market volatility

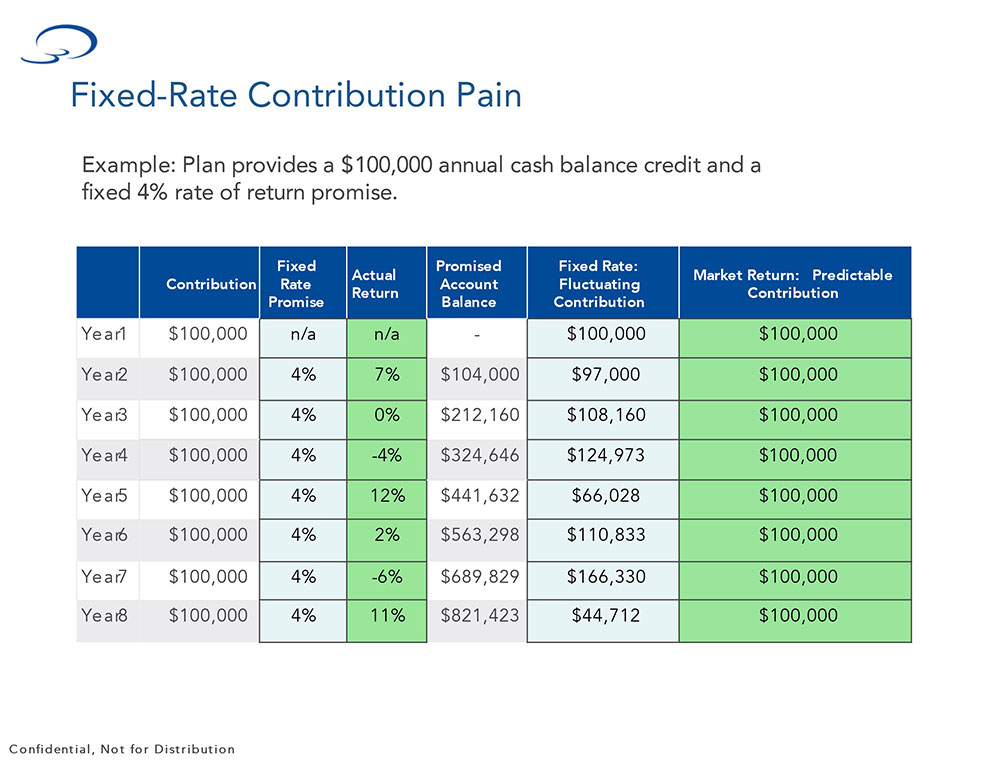

With fixed-rate cash balance plans, an employer annually provides a contribution credit and an interest credit (aka crediting rate) to each participant. The contribution credit typically is a percentage of the participant’s annual compensation or a flat dollar amount. If the investments in the plan perform poorly—for instance, if financial markets are having a rough year—the plan will be underfunded because it will still owe participants both the pay credit and fixed interest credit they were expecting.

For example, if a plan that guarantees a crediting rate of 5% but has an actual return of negative 18%, that means that the plan has a 23% shortfall which will need to be made up. If they don’t and an employee retires, there may not be enough in the plan to cover the lump sum that the employee expects to receive.

On the flipside, if the actual return is greater than the fixed rate, the plan will be overfunded and require a smaller contribution, which also means a smaller tax deduction, Phillips explained. Any fluctuation in annual contribution is problematic because generally participants want stability—so that they can plan their contributions and their tax savings accordingly.

To contend with this issue of over- or underfunding, an alternative is a market return cash balance plan. This type of cash balance plan credits participants’ accounts based on how well the plan’s assets perform. The plan’s assets are managed as a pool—rather than by individual account—but this option also gives the business providing the plan the freedom to adopt an investment strategy that works for them.

Phillips believes that last year’s market woes will be moving more businesses that sponsor cash balance plans away from the fixed rate approach and towards market rate plans. In his words: “It just gives you more predictability and flexibility.”